CeriBell, a neurodiagnostic startup known for its brain-monitoring headband that can detect seizure activity, made its market debut on Friday in an IPO that is expected to generate $180.3 million in proceeds. Here’s what to know about the medtech company and its initial public offering:

What is CeriBell?

The company was cofounded in 2014 by Jane Chao, its CEO, who is a former McKinsey consultant at and a veteran in the biotech space. Chao has a chemistry degree from Peking University and a PhD in biophysics from Cornell University.

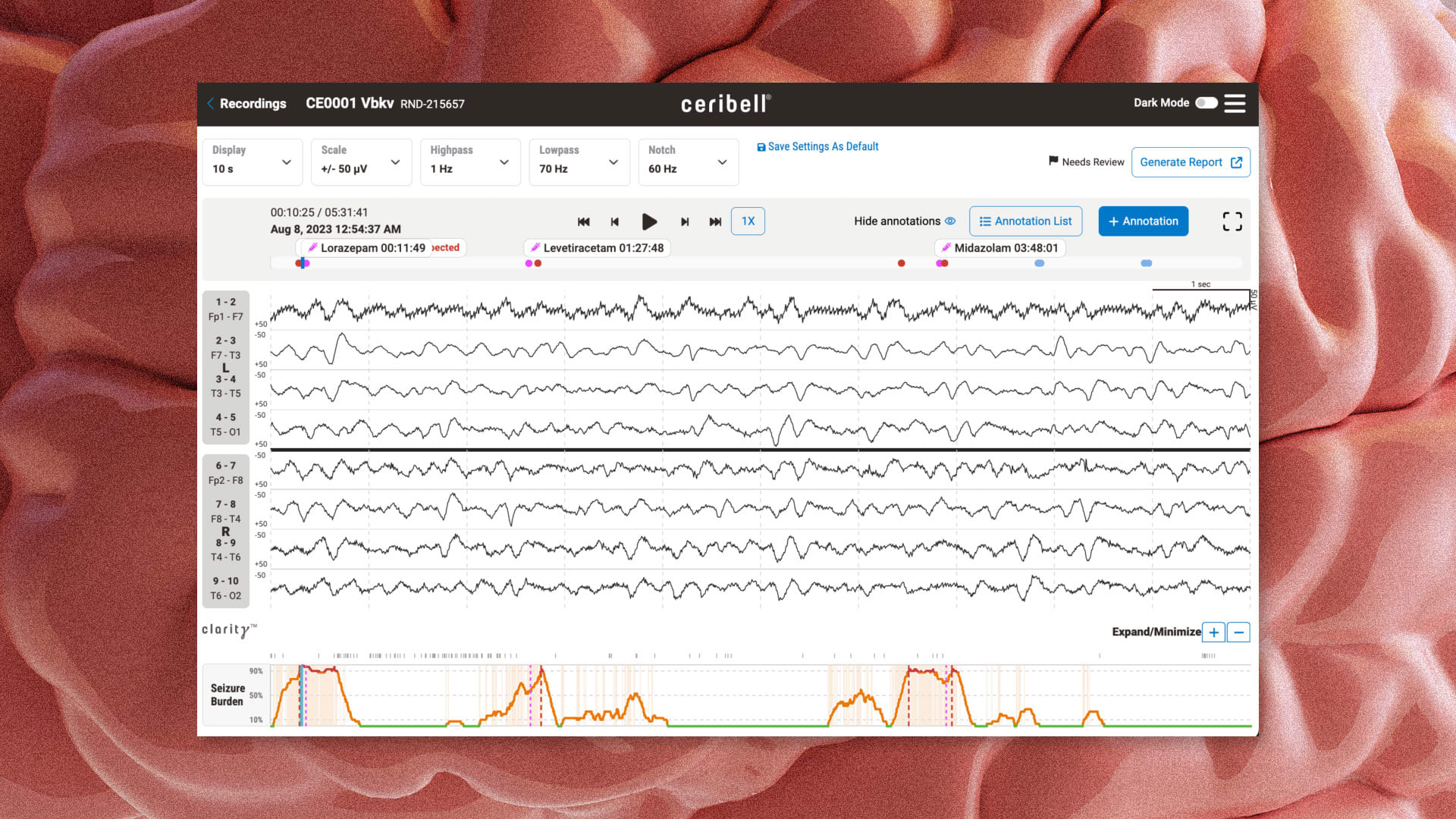

CeriBell operates an AI-powered brain-reading platform that can detect seizures. The system uses a disposable headband and EEG portal that allows for real-time bedside monitoring. The company earns money from the sale of its headbands along with subscription fees it charges to hospitals. CeriBell is based in Sunnyvale, California, and backed by investment firm TPG.

What’s happening with CeriBell’s IPO?

The company priced shares at $17 on Thursday, higher than an earlier estimated range of $14 to $16 a share. The stock is expected to debut on the Nasdaq on Friday under the ticker symbol CBLL.

How did the stock perform on its first day?

Pretty well. Shares closed at $25, an increase of more than 47%.

Is CeriBell profitable?

Not yet. According to its S-1 filing with the Securities and Exchange Commission (SEC), it had a net loss of $29.5 million on revenue of $45.2 million in 2023. But it’s moving in the right direction—its revenue grew and its losses narrowed last year when compared to 2022.

What else is there to know?

Medtech-focused IPOs in the United States have been all but nonexistent in recent quarters amid a broader downturn in the IPO market. But a report in April by JPMorgan hinted at early signs of a recovery, with medtech venture activity showing “gains in both number of deals and dollars invested quarter-over-quarter.” Needless to say, investors and Wall Street will be playing close attention to CeriBell’s stock price in the days and weeks ahead.

This story has been updated with details about CeriBell’s stock performance.

The application deadline for Fast Company’s World Changing Ideas Awards is Friday, December 6, at 11:59 p.m. PT. Apply today.